- Flores & Associates is now FloresHR. Visit our new website at FloresHR.com.

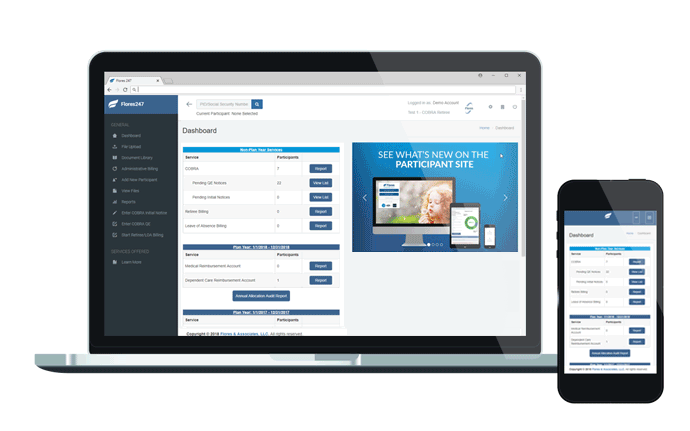

We offer a suite of integrated Better Benefits Solutions that are independent from any insurance carrier to give our clients true flexibility in the design of their benefits packages.